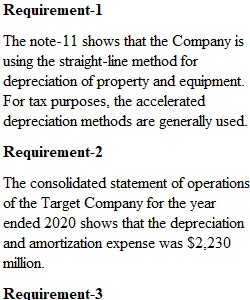

Q Description Financial Statement Case Assignments are a collection of individual assignments whose total point value equals 160. Please read the General Information and Instructions for the Financial Statement Case Assignments carefully before starting. Make sure you know how the fiscal year for Target Corporation is presented by watching the video. Financial Statement Case 10-1 Refer to the Target Corporation financial statements, including Notes 10, 11 and 12. Answer the following questions. Requirements 1. Which depreciation method does Target Corporation use for reporting in the financial statements? What type of depreciation method does the company probably use for income tax purposes? 2. What was the amount of depreciation and amortization expense as stated on the face of the financial statements, for the year ending January 30, 2021? 3. The statement of cash flows reports the cash purchases of property, plant, and equipment. How much were Target’s additions to property, plant, and equipment during the year ending January 30, 2021? Did Target record any proceeds from the sale of property, plant, and equipment? 4. What was the amount of accumulated depreciation on January 30, 2021? What was the net book value of property, plant, and equipment for Target as of January 30, 2021? 5. Compute Target’s asset turnover ratio for the year ending January 30, 2021. Round to two decimal places. How does Target’s ratio compare with that of Kohl’s Corporation? Rubric Financial Statement Case 10-1 Rubric Financial Statement Case 10-1 Rubric Criteria Ratings Pts This criterion is linked to a Learning OutcomeQuestion 1 8 pts Full Points Both parts of the question answered accurately. 4 pts Half Points 1/2 of the question answered correctly 0 pts No Points Both parts of question answered incorrectly. 8 pts This criterion is linked to a Learning OutcomeQuestion 2 4 pts Question answered correctly 2 pts Half points Half of the question answered correctly 0 pts No points Answer is incorrect 4 pts This criterion is linked to a Learning OutcomeQuestion 3 8 pts Full Points Both parts of the question answered correctly. 4 pts Half points Half of the questions are answered correctly. 0 pts No Points Answers are incorrect 8 pts This criterion is linked to a Learning OutcomeQuestion 4 8 pts Full Points Both parts of the question are answered correctly. 4 pts Half points Half of the questions are answered correctly. 0 pts No Points Answers are incorrect. 8 pts This criterion is linked to a Learning OutcomeQuestion 5 8 pts Full Points Both parts of the question are answered correctly. 4 pts Half points Half of the questions are answered correctly. 0 pts No Points Answers are incorrect. 8 pts Total Points: 36 PreviousNext

View Related Questions